Employee vs. Contractor Taxes

Employee vs. Contractor Taxes

As a business owner, you undoubtedly have some knowledge of business taxes. Many small business owners hire both employees and independent contractors to perform services and develop products. Employees and contractors differ in several ways. In this article we discuss what classifies a worker as an employee vs. independent contractor, and the tax treatment of each.

What Qualifies a Worker as an Employee?

Employees are the type of workers most people are familiar with. Employees work full-time for one employer and follow the employer’s policies and procedures. The employer designates the hours of work, location, and job duties of the employee. Employees enjoy certain legal protections, such as anti-discrimination laws and workplace environment protections. Employees typically also receive benefits, such as medical and life insurance. Employee wages are reported in a W-2 form.

What is an Independent Contractor?

Unlike an employee, independent contractors usually work for multiple clients and can designate hours and choose jobs to work on. Independent contractors are self-employed and invoice clients when a job is completed. They provide their own tools and equipment, unlike an employee. For example, a plumber working as an employee uses tools provided by his or her employer, while an independent contractor purchases his or her own tools to complete the job.

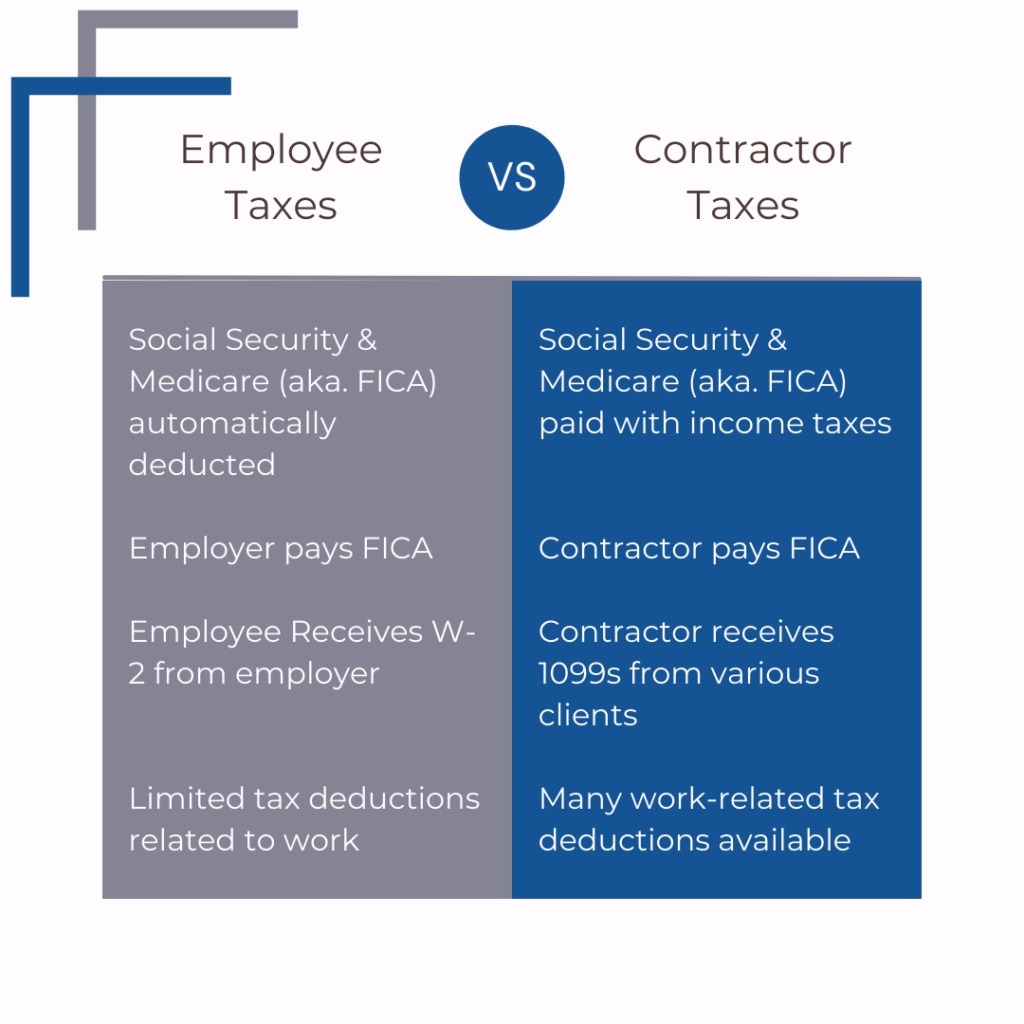

Below is a summary of the differences between employee and independent contractor

- Employees work for a single employer

- Employees are under the “control” of the employer, including hours, location, and types of work

- Employees are have legal protections, including unemployment, anti-discrimination, and worker’s compensation

- Employees typically receive benefits from their employer

- Employees receive a W-2 form, while independent contractors invoice clients according to project contract terms, and receive 1099 forms to complete their taxes.

Tax Differences Between Employee and Independent Contractor

Employee Taxes

The biggest difference between an employee and independent contractor is the treatment of Social Security and Medicare taxes (collectively referred to as FICA taxes), and income taxes. An employee has FICA taxes deducted from each paycheck, which the employer holds to remit to the government. The employer then matches the FICA deduction when making payment to the government. For example, suppose an employee owes $500 in FICA taxes during each pay period. The employer withholds $250 from the paycheck and covers the remaining $250 for the employee. The employer then remits this amount to the government. Federal and state income taxes are also withheld from an employee’s paycheck.

Independent Contractor Taxes

Independent contractors do not have FICA, state, or federal income taxes withheld from payments received. Because independent contractors do not work for an employer, they must send the government the full amount of FICA taxes owed when filing their tax return.

Independent contractors handle the full amount of FICA taxes owed. Currently, the self-employment tax rate is 15.3% (12.4% for Social Security and 2.9% for Medicare). Half the amount of FICA taxes is deductible, helping ease the burden of FICA taxes. As you can see, making quarterly FICA tax payments helps avoid a substantial tax bill when filing in April.

Tax Form Differences

Employees receive a W-2 form from their employer by January 31 to file taxes on wages earned the previous year. The form states wages earned, withholding amounts, retirement contributions, and additional information relevant to the employee’s tax filing.

Clients of an independent contractor provide a W-9 form that the independent contractor completes. The employer then provides a 1099-MISC form to the independent contractor with earnings details. The independent contractor receives a 1099-MISC form from each client he or she earns income from.

Here are four additional tax differences between independent contractors and employees

- Independent contractors report self-employment income Schedule C

- Self-employment tax is filed through a Schedule SE

- Independent contractors make quarterly estimated tax payments

Deductions Available to Independent Contractors and Unique Tax Deadlines

There are several tax deductions available to independent contractors that are not available to employees:

- Home office deduction

- Health insurance

- Mileage

- Business equipment such as laptops

- Qualified Business Income Deduction

Independent Contractor Tax Filing Deadlines for Quarterly Tax Payments

- April 15 – income earned from January to March

- June 15 – income earned during April and May

- Sept 15 – income earned from June to August

- Jan. 15 – income earned from September to December of prior year

Common Issues with Independent Contractor Taxes

Cash payments

Another issue worth discussing is the tax treatment of cash payments. The IRS states that all income, however received, is taxable. Independent contractors often receive cash payments for services rendered. Although many believe these “under the table” payments are not taxable because they are made in cash, they are indeed taxable. The way income is received does not matter, whether it is a traditional check, wire transfer, cryptocurrency, or cash. Any income must be reported to the IRS to avoid penalties.

Documentation

Because independent contractors work for several clients, keeping accurate records is necessary for accurate tax filings. Each client will send a 1099-MISC form to the independent contractor, so creating procedures to accurately update accounting records can save time and avoid penalties when filing taxes.

We hope this short article is helpful in clarifying the different tax treatment of employees and independent contractors. If you are interested in further information, be sure to check out the rest of our website and blog or schedule a consultation for a personalized consultation.