The #1 Reason Why Most Entrepreneurs Are Not Profitable in The Beginning

The #1 Reason Why Most Entrepreneurs Are Not Profitable in The Beginning

Every business has a goal of turning hard work into profit. However, sometimes that hard work breaks even with expenses, leaving little for the owners to reinvest or pay themselves. This is a common issue among entrepreneurs, especially those who recently opened their doors.

What if we said it is possible to make a profit, even from the beginning? From the start of your first sale profit is a possibility, not something reserved for the uber successful.

In this article, we are going to dive into the #1 reason why most entrepreneurs aren’t profitable in the beginning. Then we are going to explain how you can begin seeing profit on your financial statements every month.

Income vs. Profit

Before we get too far into the details, we would like to quickly differentiate between income and profit.

Income is all cash your business brings in. This can be active income like in exchange for goods or services. It can also be passive income like investment income or dividends. Both are forms of income and all are shown at the top of your income statement (also known as your Profit & Loss Statement).

Profit is what is left over after you pay your operating expenses and indirect expenses. Everything from the raw materials that go into making each unit of product to the pencils you purchased for the office. Deduct these expenses and what you are leftover with is profit.

Our goal for you is to consistently see profit on your income statement and be able to predict the profit you make from each sale.

The #1 Reason

Ok, now that we have reviewed the difference between income and profit let’s discuss how we got here in the first place. What is the #1 reason why most entrepreneurs are not profitable in the beginning?

It is not a priority!

This may sound strange to those hard working entrepreneurs – but hear us out. Priorities you carve out time for. It is always top of mind and you bend the rest of your schedule to make sure those priorities are taken care of. If something is interfering with your priority, you put more energy into making sure it does not happen again.

Now think about the income that is brought in. With every dollar you make, are you carving out space for profit?

What many entrepreneurs fall into the trap of is profit being the result of whatever is leftover. After your expenses are paid, taxes are taken care of, and maybe, just maybe, you have a bit to pay yourself – you then have profit.

We want to flip the script.

How to Make A Change

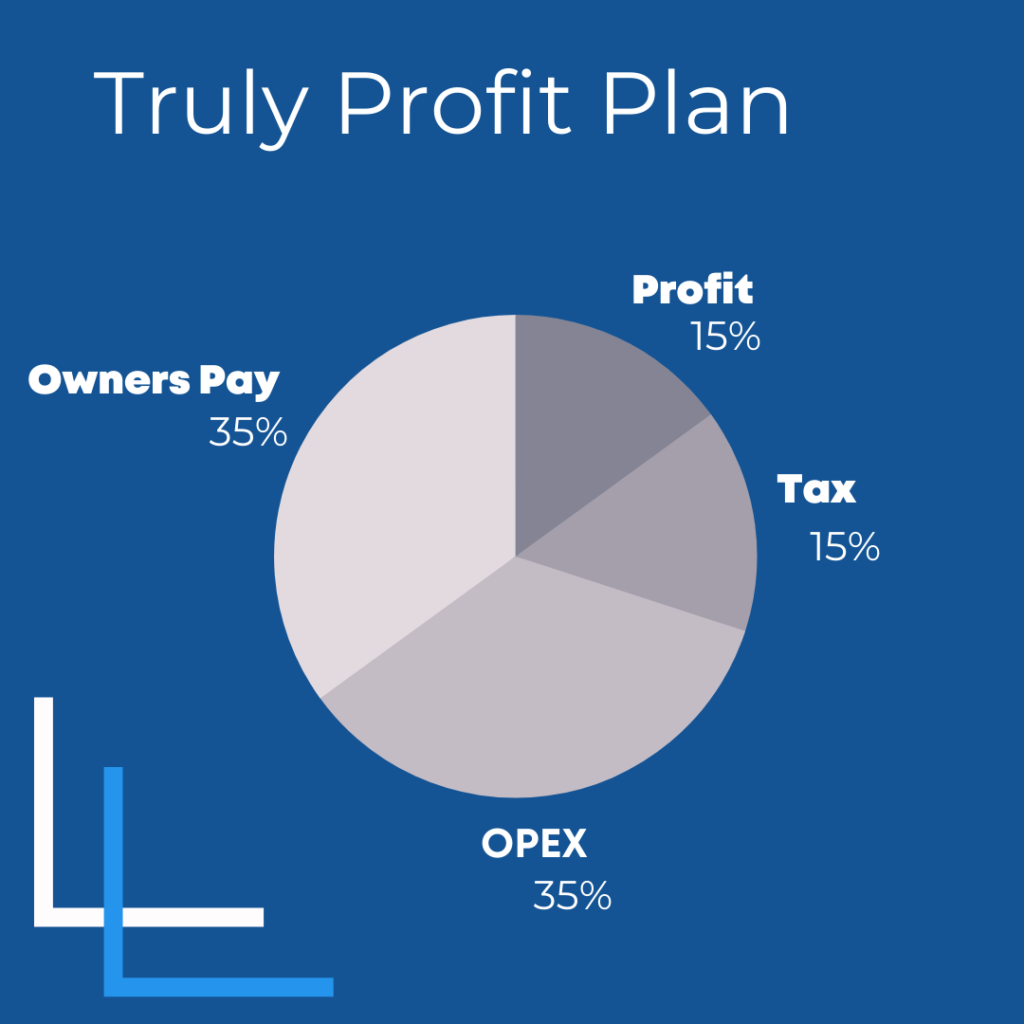

With The Truly Profit Plan for Business Owners, we challenge you to take the profit out first.

What does this mean for entrepreneurs? This means for every dollar you earn, the first step is not to pay the bills but to set aside your profit. In other words, make it a priority.

Once your profit is set aside you will be one step closer to the Truly Profit Plan.

We recommend continuing this thinking with your tax, owners pay, and operating expenses. In fact, with every dollar you earn you will want to separate it into the following buckets:

- Owners Pay – 40%

- Taxes – 10%

- Profit – 10%

- Operating Expenses – 40%

Once you have set aside the appropriate amounts you will have your budgeted totals. Not only does this ensure you a profit each month, but it will force you to look more closely at your expenses. What expenses do you really need and where can you creatively save a bit of income?

Being an entrepreneur is hard work with a lot of risk. No matter the industry or business model, each entrepreneur often has the same self doubts and struggles in those early years of setting up their business.

Our hope for you is that you feel informed with your financial statements, empowered with the information they provide, and inspired to find creative solutions that increase profitability.

Click here to Get Started!

hello@trulybookkeeping.com