How To Aggressively Save For Retirement in Your 20s

How To Aggressively Save For Retirement in Your 20s

Plenty of us are procrastinators. We procrastinate on going to the gym, doing the dishes, the laundry, heck – most of us procrastinate on our taxes! These procrastinations often affect our life in minimal ways. However, procrastinating on preparing for retirement can have huge negative consequences to your life.

These strategies aren’t how to save a little bit for a rainy day or stop buying lattes. Instead, we are going to share with you very real ways you can aggressively save for retirement because here’s the thing: Your 20’s are the BEST time to aggressively save for retirement.

When you are in your 20’s you have something every other age group does not have and that is time. In short, you have time to make riskier investments because you are playing the long game. Let’s dig into this some more.

Why Start Now

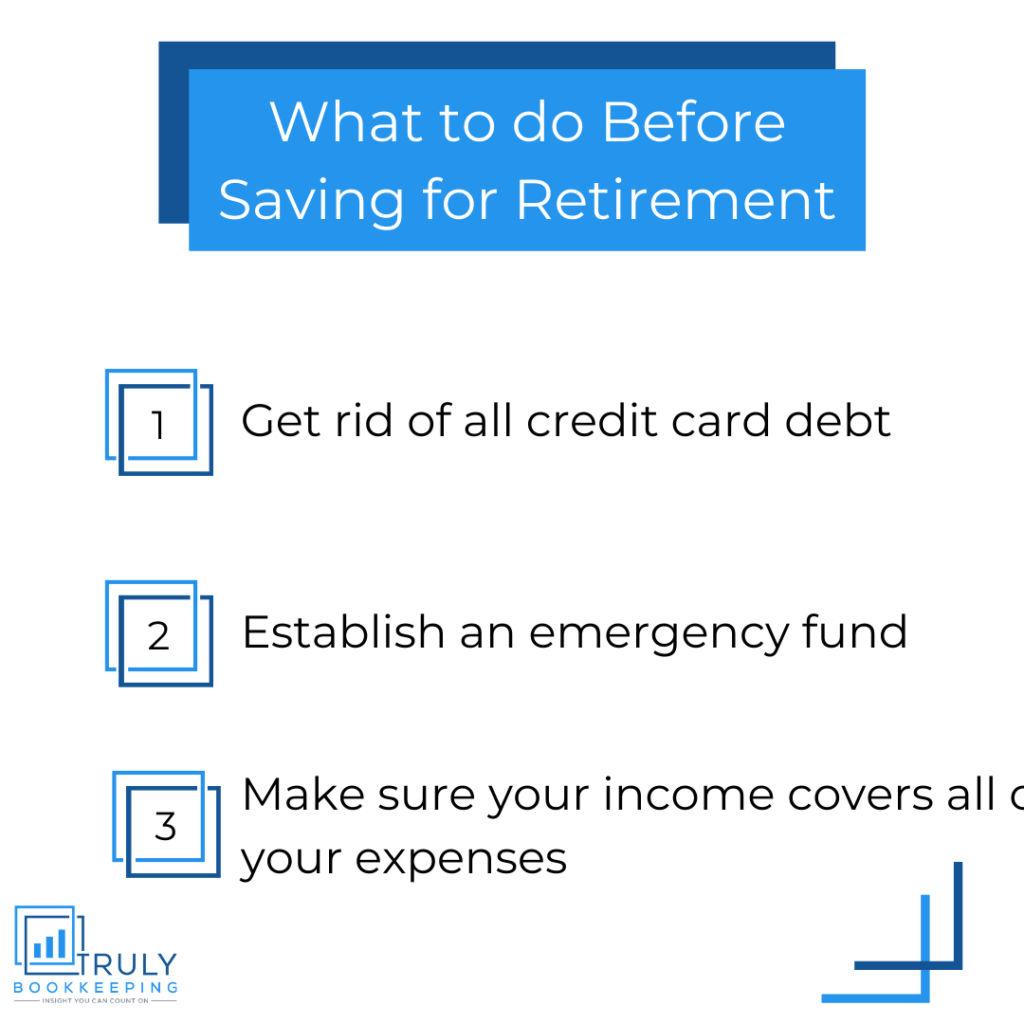

Saving for retirement now allows you to retire comfortably. However, there are some things you should make sure are in order first:

- Do not have any credit card debt (pay off your balance in full each month)

- Have an emergency fund (3-6 months of living expenses)

- Have a job that can cover your expenses (side hustles are an option too!)

These points are of course easier said than done, but if any of them have not been met then they should be considered first before moving onto retirement. If you do not have debt, have an established emergency fund, and a job that covers your expenses, then it is time to begin saving for retirement.

What To Do First

Saving for retirement involves a bit of strategy. When we say save, we do not mean you open up a savings account and deposit money into it every month or so. There are currently systems in place that help you save by increasing your investment or holding the money until you are an appropriate age to retire.

One of the first things you should do is begin putting money into a Traditional IRA, Roth IRA, or some sort of retirement savings account. You can set one up even if you are an entrepreneur or do not have an employer with retirement benefits. This is a two step process:

- Transfer money into these accounts each month.

- Invest the cash you transferred into a low cost Index Fund or ETF. (Don’t forget these crucial step!! If you don’t invest the cash, you lose out on all the growth the stock market is known for when holding for long periods of time.)

Depending on which one you choose, there will likely be some sort of tax benefits. For example, if you have a traditional IRA, then you can get a deduction on the amount you contribute. If you have a Roth IRA, you do not immediately get a tax benefit, but when you withdraw the funds during retirement they will be tax free.

This is where we suggest you start.

Investing

If you start investing in your 20’s there is a good chance the market will crash between now and when you retire. There is also a good chance it will repair itself within that time frame and MORE! This is why it is recommended you save aggressively in your 20s.

As you get older you can move into more conservative and predictable investments.

When you are in your 20’s an aggressive portfolio would look like investing in international stock and Large-cap stock.

The Balance provides a great illustration of what an aggressive versus conservative investing strategy looks like. Consider each pie chart and think about them as decades. The aggressive pie chart is ideal for those in their 20s, whereas moderately aggressive could be a good strategy for someone in their 30s, and so on.

http://www.thebalance.com/best-retirement-strategies-for-your-20s-4177587

While it is important to begin saving for retirement, it is first important to make sure you and your business are financially stable. Be aggressive with taking control over your finances, then once you have a solid foundation, be aggressive with your investments.

If you are ready to get control of your business finances, check out The Truly Profit Plan for Business Owners here.

Click here to Get Started!

hello@trulybookkeeping.com