Truly Profit Plan for Entrepreneurs

Truly Profit Plan For Entrepreneurs

If you are an entrepreneur just getting your business off the ground, organizing your finances is probably one of the most daunting tasks. Maybe you aren’t sure whether you are using Quickbooks right or you know something needs to be done for taxes…you just aren’t sure what??

There is a lot that goes into running the financial end of any business and if this is your first venture, you may not even know what you don’t know.

One part of your business that should NOT be stressful is setting a budget. There are a million methods on how to budget, but we believe the Truly Profit Plan is the easiest way to control your finances.

_____________

⇒⇒⇒ To Get the Truly Profit Plan, Click Here

______________

What is the Truly Profit Plan?

The Truly Profit Plan does a number of things for business owners but the aspects our clients find the most helpful include:

- Easy & realistic budgeting

- Ensuring business owners get paid

- Scalable

These are 3 things the Truly Profit Plan helps establish. Coincidentally, it is also the 3 things first time entrepreneurs often struggle with.

How Does it Work?

When creating a budget, most methods begin by laying out your expenses. Then you calculate how much you need to make based on those expenses. The Truly Profit Plan reverses this and calculates how much you are allowed to spend on expenses – after you have paid yourself.

Traditional Budgeting:

Income – Expenses = Profit

Truly Profit Plan:

Income – Profit = Expenses

By flipping the script, you ensure your business is always profitable and gives you a budgeted amount to spend on your expenses.

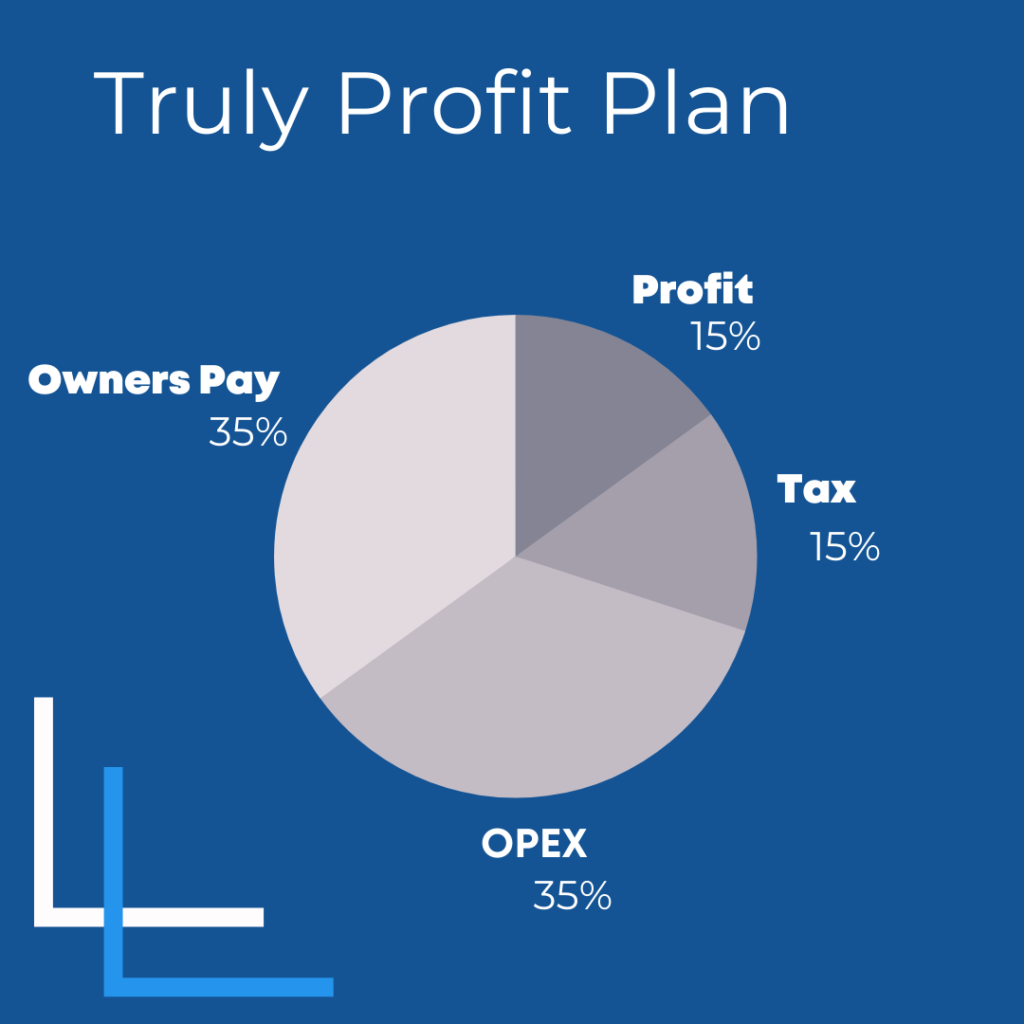

Ok, here’s how it works: You take your total income for a set period, and break it out into 4 categories which has a percentage assigned to it:

- Owner’s Pay – 35%

- Taxes – 15%

- Profit – 15%

- Expenses – 35%

For example, let’s say you made $1,000 in a period. You would calculate:

- Owner’s Pay – $350

- Taxes – $150

- Profit – $150

- Expenses – $350

At the end of the period, you would have some pay for yourself, a reserve for tax expenses, a bit of profit to save, and a budgeted expense amount of $350.

Controlling Your Expenses

Part of the reason this method is so easy to understand is because it is very straightforward. There is no forecasting or disappointment at the end of the month when you cannot pay yourself. Instead, you are given a limit on how much you can spend with your expenses.

Let’s refer to our previous example. Assuming you made $1,000 in a period, you have a budgeted amount of $350 in expenses for your upcoming period. Add up all of your expected expenses and if you do not foresee yourself making the budgeted amount, it is time to do some cuts.

It may hurt and make your processes a bit more complicated, but it is worth the financial peace of mind.

Scalable

The last important point to make is how easy it is to use the Truly Profit Plan as you scale your business. Even if there is an economic downturn and you lose some income, the Truly Profit Plan allows you to easily watch your 4 categories and adjust. You can scale month by month, which is even more reassuring for new businesses when your income is more unpredictable.

If you have decided the Truly Profit Plan is the perfect way to begin getting control over your finances, then it is time to get started. Begin by downloading our free ebook here. It will walk you through the steps of setting up your business with this plan.

Already use the Truly Profit Plan? We would love to hear from you! Send us your story. What has changed in your business? Have you found it easier to manage your expenses? Maybe you are finally able to pay yourself for your hard work – we want to hear about it!

Send us your story here -> hello@trulybookkeeping.com

If you’re ready to put these concepts Into practice, I’d love to chat with you about working together to make that happen.